Thought Leadership

Thought

Leadership

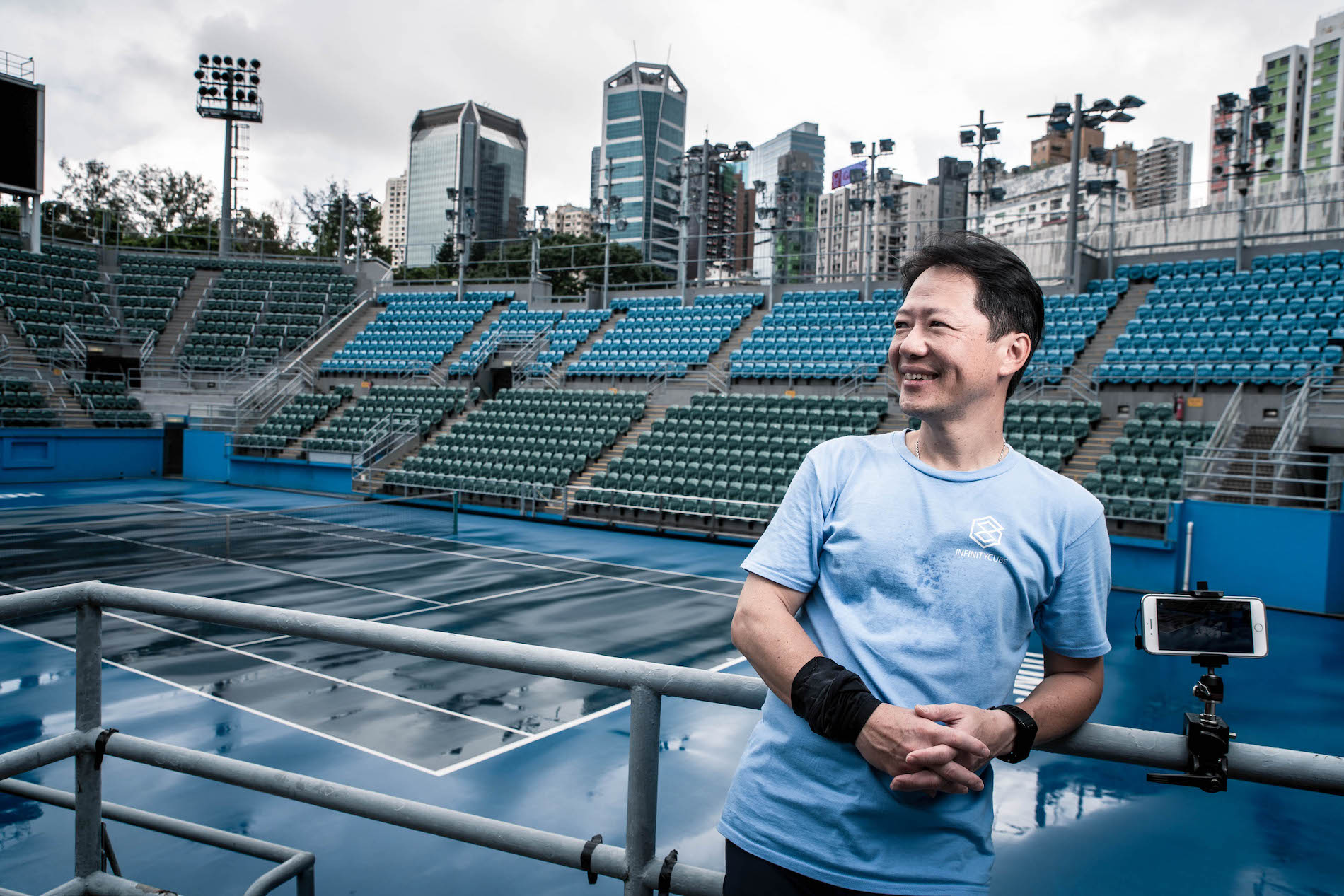

After years working for large international companies, including one of the Big Four, Victor Tan, Co-founder of Infinity Cube, identified a need in the market. The Institute member co-founded the sports technology start-up, and with research and development funding support from the HKSAR’s Innovation and Technology Fund, developed an AI system. Following two successful public pilots of the system’s tennis match officiating technology with the Hong Kong Tennis Association (HKTA), the governing body for tennis in Hong Kong, the HKTA had agreed to licence the technology for use in its tennis tournaments and matches. The system can also be used to assist with coaching. In this picture, Victor tests the technology at Victoria Park Centre Court.

+

Our thought leadership advocates on issues which have an impact on our profession and is dedicated to the betterment of Hong Kong and the wider world.

Throughout the year, the Institute has strived to develop thought leadership to address ongoing issues within the profession and the city.

Supporting the new anti-money laundering regime

Anti-money laundering (AML) was a hot topic this year as the Institute liaised closely with the Financial Services and the Treasury Bureau and Companies Registry on proposals for new legislative requirements on AML. The Anti-Money Laundering and Counter-Terrorist Financing Ordinance (AMLO) 2018 subsequently came into effect from 1 March 2018, extending the scope of previous money laundering laws to cover designated non-financial businesses and professions, including accountants.

To help members comply with the new rules, the Institute issued Guidelines on Anti-Money Laundering and Counter-Terrorist Financing for Professional Accountants also on 1 March 2018, after the Institute’s AML working group considered members’ views in a consultation. A series of AML seminars and workshops were also organized to deepen members’ knowledge on AML issues.

The Institute worked with accountancy consultants, SWAT UK, to publish an AML procedures manual. Published in June 2018, the manual provides guidance together with example policies and procedures to help members to fulfil their obligations under the guidelines, AMLO and other applicable ordinances. The Institute also negotiated favourable subscription rates for members with two market leaders in AML screening solutions: Thomson Reuters and Dow Jones.

The Institute and representatives from member firms will meet assessors from the Financial Action Task Force later this year, as part of the mutual evaluation of Hong Kong’s AML regime.

Advocating for the best corporate governance

Our 18th annual Best Corporate Governance Awards presented a total of 20 awards, special mentions and commendations, to 18 different companies and organizations, including awards for sustainability and social responsibility reporting, and commendations in the specific areas of board & audit committee, risk management and internal control, and website corporate governance information. The Secretary for Financial Services and the Treasury, James H Lau Jr, was guest of honour at the awards presentation ceremony in November 2017. To further promote good corporate governance, award winners have been invited to share their knowledge and experience on different aspects of corporate governance including environmental, social and governance reporting with Institute members, as part of a series of events.

This year, the Institute released its substantial Report on Improving Corporate Governance in Hong Kong, covering the findings of an independent comparative study of the corporate governance regimes in Hong Kong, the United States, the United Kingdom, Mainland China and Singapore. The report, prepared by Syren Johnstone and Say H. Goo of the University of Hong Kong’s Asian Institute of International Financial Law, made 28 recommendations to further develop the framework and enhance the city’s attractiveness to investors. These include strengthening the role and accountability of independent non-executive directors, establishing a corporate governance policy unit to lead and formulate relevant policies, and addressing regulatory gaps. Based on the report, a series of events were organized to raise members’ awareness to understand the corporate governance system in Hong Kong and developments elsewhere.

To promote the report to a wider audience, the Institute is publishing extracts of the report as thought leadership articles on specific topics in our monthly magazine, A Plus. The aim is to produce longer white papers over the coming year.

Campaigning for a fairer Hong Kong

With regards to the 2018-19 government budget, we submitted our tax policy and proposals to the Hong Kong Financial Secretary and explained the rationale behind our recommendations at a press conference, in February 2018, hosted by the Chairman of the Taxation Faculty Executive Committee KK So, and the Convenor of the Budget Proposals Subcommittee, Curtis Ng.

On budget day, the committee’s chairman and subcommittee’s convenor gave media interviews to share the Institute’s view on the budget. A lively panel discussion took place on the evening of the budget day, involving Kenneth Leung, Legislative Council accountancy representative, Regina Ip, Member of the Executive Council of the Hong Kong government, and the committee’s chairman and subcommittee’s convenor.

News websites covered interviews with Curtis Ng, also a Deputy Chairman of the Taxation Faculty Executive Committee, regarding tax measures in the Policy address in October last year. The Institute welcomed the proposed changes to the profits tax regime to support small- and medium-sized enterprises, and the proposed tax deduction for research and development, which were in-keeping with measures that we had been advocating for some time.

Consultations and specialist meetings

The specialist interest groups and other committees also met with various government bodies and contributed their expertise to a number of proposals.

Detailed minutes of last year’s annual meeting between representative of the Institute’s Taxation Faculty Executive Committee and the Commissioner and senior staff of the Inland Revenue Department were published on our website. The minutes of the 2018 annual meeting will be published later this year.

During the reporting period, the Institute’s Forensics Interest Group (ForensIG) has been actively engaging with university students through presentations that highlight the role of forensic accountants, and the wide-ranging career opportunities in the field. ForensIG nominated a speaker to join a panel discussion at the Chinese University of Hong Kong’s Global Business Forum, where senior executives and business leaders shared their experiences with students.

The Institute contributed its knowledge and expertise on a range of consultations throughout the year, and made proposals to the following organizations:

Financial Services and the Treasury Bureau (Financial Services)

- Suggestions on specific issues, relating to the statutory framework for corporate rescue and insolvent trading

- Input into information requests from the Financial Action Task Force, in preparation for the assessors’ mutual

evaluation visit to Hong Kong

Financial Services and the Treasury Bureau (The Treasury)

- Potential tax treaty partners for Hong Kong

- Removal of “ring-fencing” features from tax regimes for funds

- Tax incentives for research and development (also submitted to the Innovation and Technology Commission)

Hong Kong Exchanges and Clearing Limited

- Review of the corporate governance code and related listing rules

- Delisting and other related rule amendments

- Backdoor listing, continuing listing criteria and other related rule amendments

Securities and Futures Commission

- Open-ended fund companies – Rules and Code

Legislative Council Bills Committees

- Anti-Money Laundering and Counter-Terrorist Financing (Financial Institutions) (Amendment) Bill 2017 and

Companies (Amendment) Bill 2017

- Inland Revenue (Amendment) (No. 4) Bill 2017, on extending profits tax exemption to privately-offered

open-ended fund companies

- Inland Revenue (Amendment) (No. 6) Bill 2017, on transfer pricing and other measures relating to the Base

Erosion and Profit Shifting initiative

- Inland Revenue (Amendment) (No. 7) Bill 2017, on a two-tier tax system

- Inland Revenue (Amendment) (No. 2) Bill 2018, on tax deductions for capital expenditure incurred for the

purchase of intellectual property rights

- Inland Revenue (Amendment) (No. 3) Bill 2018, on tax deductions for research and development expenditure

- Inland Revenue (Amendment) (No. 5) Bill 2018 on budget tax concession measures

Mainland China

- The National People’s Congress of People’s Republic of China – Exposure draft of the revised Individual Income

Tax Law

International body

- International Federation of Accountants – Comments on updating the Financial Action Task Force’s Risk-based

Approach Guidance for Accountants