Standards, Ethics and Regulation

Standards, Ethics

and Regulation

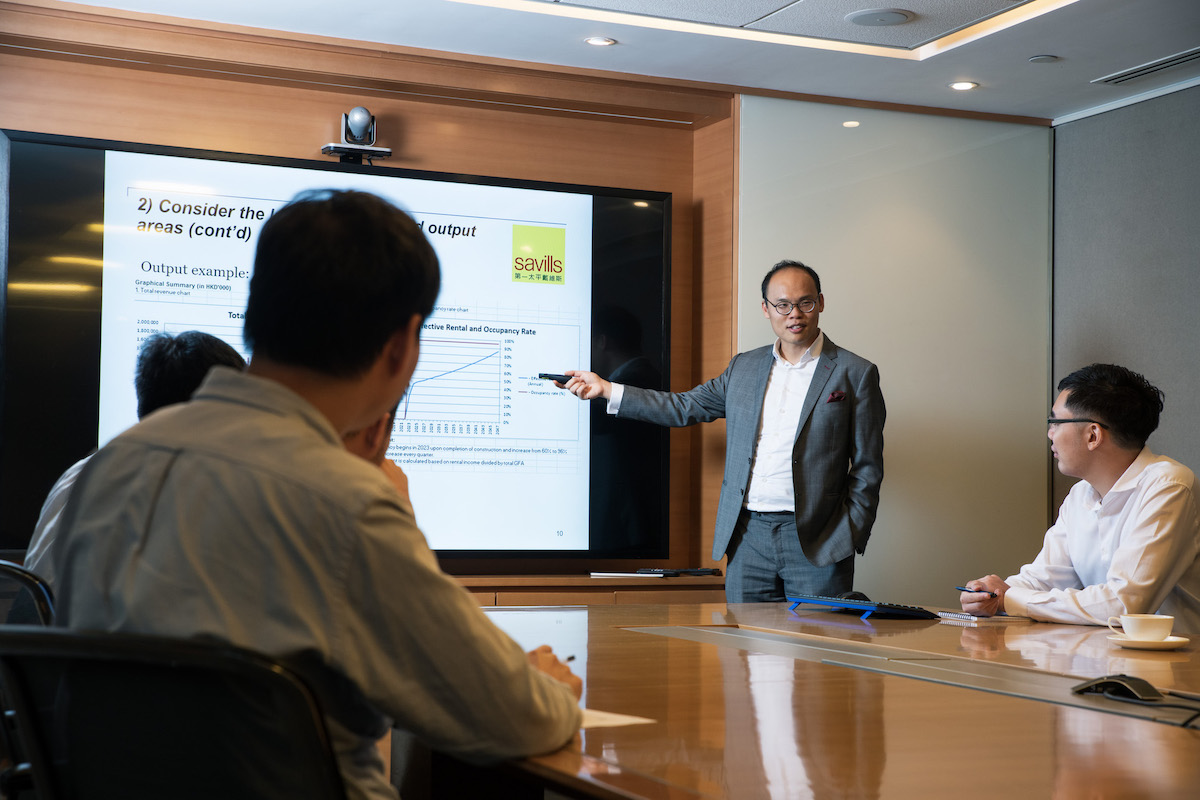

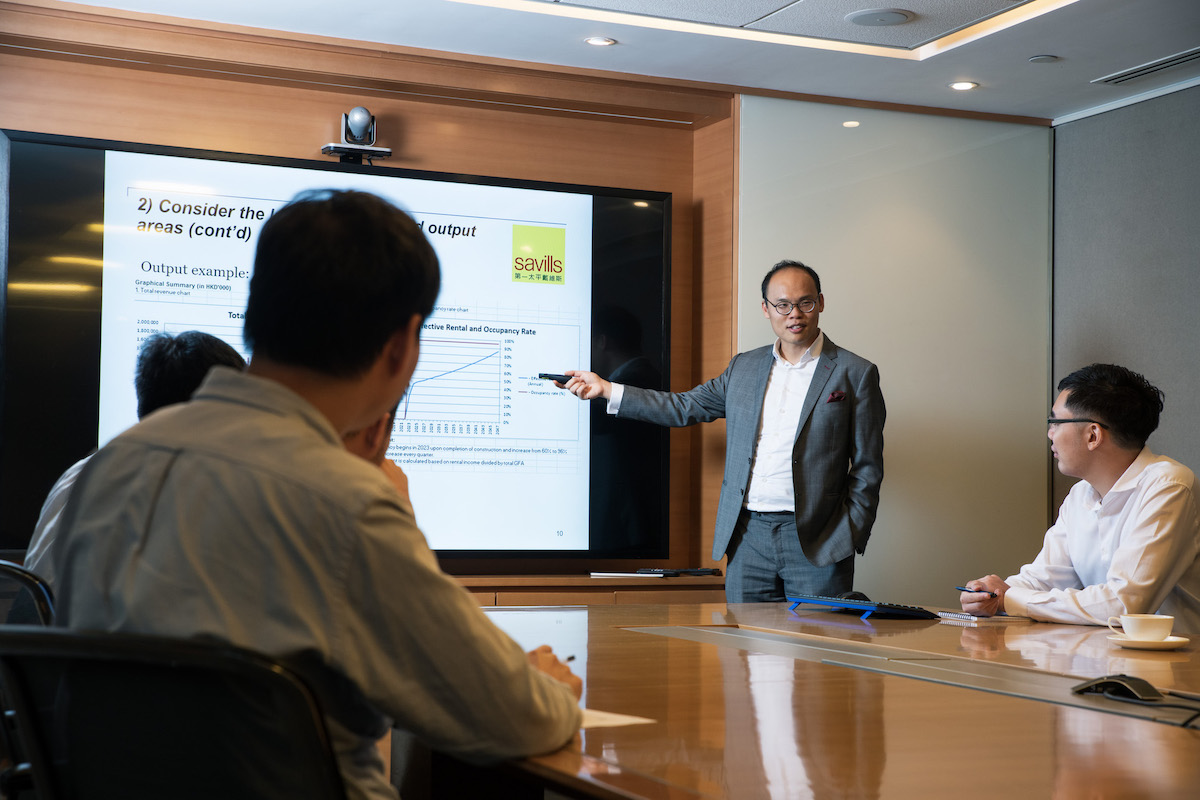

Outside of traditional accounting and auditing, CPAs are increasingly involved in business valuations, helping to ensure valuations are reasonable. Entry requirements for valuers need to be as rigorous as they for accountants, Sir David Tweedie, Chairman of the International Valuation Standards Council, once suggested. In this picture, Institute member Wiley Pun, Director, Business and Financial Instrument Valuation, at global real estate services provider Savills, conducts an internal training session on valuation best practice at the Hong Kong office.

+

The Institute is the body responsible for setting accounting, auditing and ethics standards in Hong Kong and is committed to full convergence with international standards. This means we play a crucial role in safeguarding a high quality of financial reporting by companies based or listed in Hong Kong, and maintaining the city’s position as an international financial centre.

The Institute’s active involvement at the development stage of international standards ensures that the views and concerns of our stakeholders are effectively expressed and considered on the global stage.

During the year, we closely collaborated with international standard setting bodies, such as the International Financial Reporting Standards (IFRS) Foundation, the International Auditing and Assurance Standards Board, and the International Ethics Standards Board for Accountants (IESBA) and national standard setters. We continued to play a leading role in the activities of the Asian-Oceanian Standard-Setters Group (AOSSG), and also participated in World Standard Setters meetings and the International Forum of Accounting Standard Setters.

The Institute identifies the most suitable candidates for international standard setting bodies and supports them during the nomination process. Alden Leung was appointed to the IESBA, effective January 2018, and we have been working closely with him in his new role, sharing our views, and those of Hong Kong stakeholders on important topics. Since December 2017, the Institute has been representing the AOSSG at the International Accounting Standards Board’s (IASB) Accounting Standards Advisory Forum on technical topics, such as business combinations under common control and revenue.

At home, we issued HKFRS 17, the insurance contracts standard, in January. The standard is recognized as one of the most significant changes to insurance accounting in decades. We spoke with Hong Kong auditors, companies, investors and regulators on how to improve the quality of auditing, company reporting, and the effectiveness of standards. We have also continued our research projects on revised auditor reports for listed companies, and accounting for mergers and acquisitions. Our findings from these studies were shared locally, to raise awareness, and internationally in an effort to contribute to the development of global standards.

Also in January, the Institute and the IFRS Foundation Trustees co-hosted a dinner welcoming over 100 senior representatives of leading listed companies, investment firms and regulators to exchange views on the topic of “Hong Kong and IFRS Standards: Past, Present and Future.” Together with the AOSSG, the Institute also spoke with the Trustees regarding other financial reporting matters concerning Hong Kong and the region.

In addition to setting standards, the Institute advocates high quality wider corporate reporting. We hosted the launch of the Natural Capital Coalition’s Supplement to the Natural Capital Protocol Connecting Finance and Natural Capital. Business and finance leaders attended the event and were offered first access to the new global guidance. They also heard practical case studies from leading financial institutions, and debated the drivers and challenges to becoming pioneers of natural capital. We also hosted meetings for the International Integrated Reporting Council with Hong Kong academics, companies, non-governmental organizations, CPA firms and regulators on the relevance of integrated reporting in the city.

The Institute also co-hosted the Monitoring Group’s roundtable discussions in Hong Kong, with audit practitioners, regulators and professional bodies from the region on the Monitoring Group’s proposals to restructure the international auditing and ethical standard setting.

Supporting the application and implementation of standards

Our technical resources webpage is regularly updated to ensure members have convenient access to all technical information in one place. Through our LinkedIn showcase page, weekly e-circular and monthly TechWatch bulletin, the Institute is committed to keeping members and other stakeholders informed of new and revised standards. Additionally, we made sure such standards were communicated to members and the public in an informative and timely manner through articles published in our official monthly magazine A Plus.

Strengthening members’ core skills is a key priority of the Institute, and to help achieve this goal the Institute organizes a range of technical events, courses and access to a range of online resources – more details of which can be found in Chapter 4 Member support and professional development.

The Institute’s flagship Audit Practice Manual continues to be in demand after the launch of the second edition in December 2016.

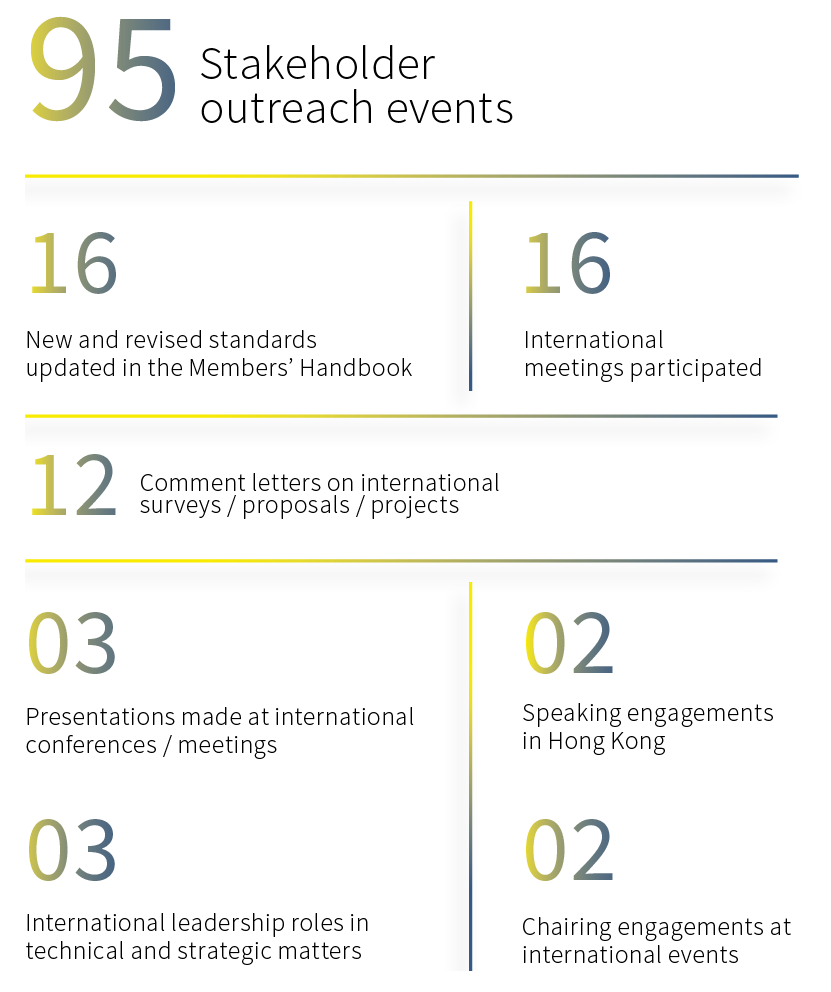

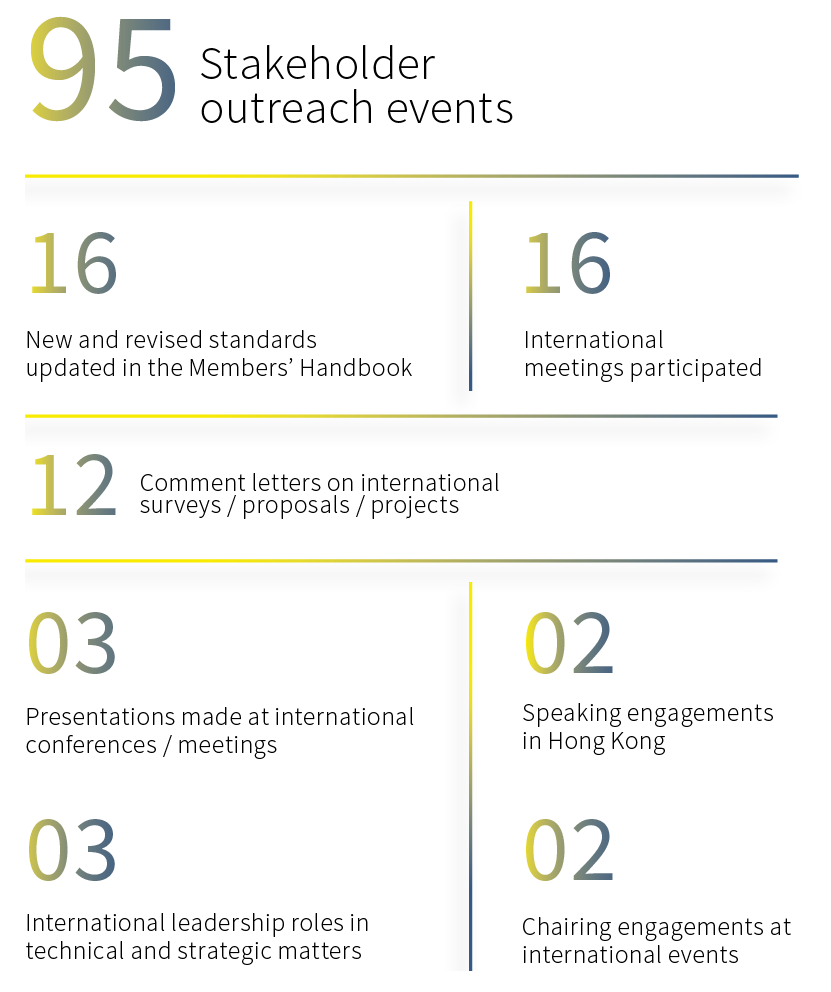

The Institute’s 2018 activities for standards development

Quality assurance

Through two quality assurance programmes, practice review and professional standards monitoring, the Institure is able to enhance, monitor and maintain public trust in the quality of work conducted by our members.

The practice review programme consists of inspections and reviews of audit practices in Hong Kong. By meeting the international best practices, the programme gives priority to reviewing practices with listed company clients. During the reporting period, 229 site visits and 94 desktop reviews were carried out by Institute staff, while the Practice Review Committee considered 283 reports.

Where deficiencies were identified, the committee directed firms to implement remedial action, required additional site visits be scheduled, or complaints be filed against the practices. A total of seven cases proceeded to complaints, while another two cases concerning the audits of listed companies were referred to the Financial Reporting Council for further investigation.

This year, a plan was introduced to shorten the review cycle for practices without listed clients, to six years. The plan also aims to complete the reviews of practices that have not yet been reviewed, within a three-year period, under the revised practice review programme. A number of measures have been implemented, along with the plan, to enhance the efficiency of the reviews, such as the introduction of a self-evaluation process for small practices with a limited number of private clients.

The Institute referred a number of cross-border engagements to the Supervision and Inspection Bureau of the Chinese Ministry of Finance for review under our memorandum of understanding.

The Quality Assurance Department (QAD) and Practice Review Committee monitored existing practice review outcomes, and to enhance effectiveness, introduced new elements and procedures to the practice review programme.

The second review system is the professional standards monitoring programme, which involves reviewing published financial statements of Hong Kong’s listed companies, including those of H-share companies audited by Mainland audit firms. A total of 90 sets of financial statements were reviewed during the year, and 31 letters were sent to auditors with recommended revisions and improvements. In one case, potentially significant non-compliance with professional standards were identified and the case referred to the Financial Reporting Council for investigation. Findings from both programmes were published in the annual Quality Assurance Report and communicated to members and stakeholders via articles and technical education events.

The Regulatory Oversight Board ensures that QAD activities are carried out in accordance with strategies and policies determined by Council. The oversight work includes receiving and reviewing work plans of the QAD, progress reports from management, and an annual report from the Practice Review Committee, regarding its process review of the QAD practice review activities. The results of the process review were positive, and showed that the QAD practice review activities meet statutory requirements and international standards.

Compliance

Effective regulation of the Institute’s members helps maintain public confidence in the accounting profession. Failure to properly comply with technical and ethical standards will result in regulatory actions.

Compliance Department staff apply consistent procedures to investigate complaints against the Institute’s members, member practices and registered students, concerning their ethical and professional conduct.

Each complaint is reported to the Professional Conduct Committee (PCC) for further evaluation.

The PCC has the power delegated by Council to dismiss unsubstantiated complaints and adjudicate minor ones by issuing disapproval letters. The committee refers more serious complaints to Council with recommendations for appropriate actions. For moderately serious cases, which meet a set of pre-determined criteria, the PCC may recommend the offer to respondents of a non-negotiable Resolution by Agreement (RBA), in lieu of formal disciplinary proceedings. Serious cases are referred to the Disciplinary Panels to be determined by independent disciplinary committees. All RBAs and disciplinary findings are published in A Plus, and on the Institute’s website, to ensure the enforcement process remains transparent.

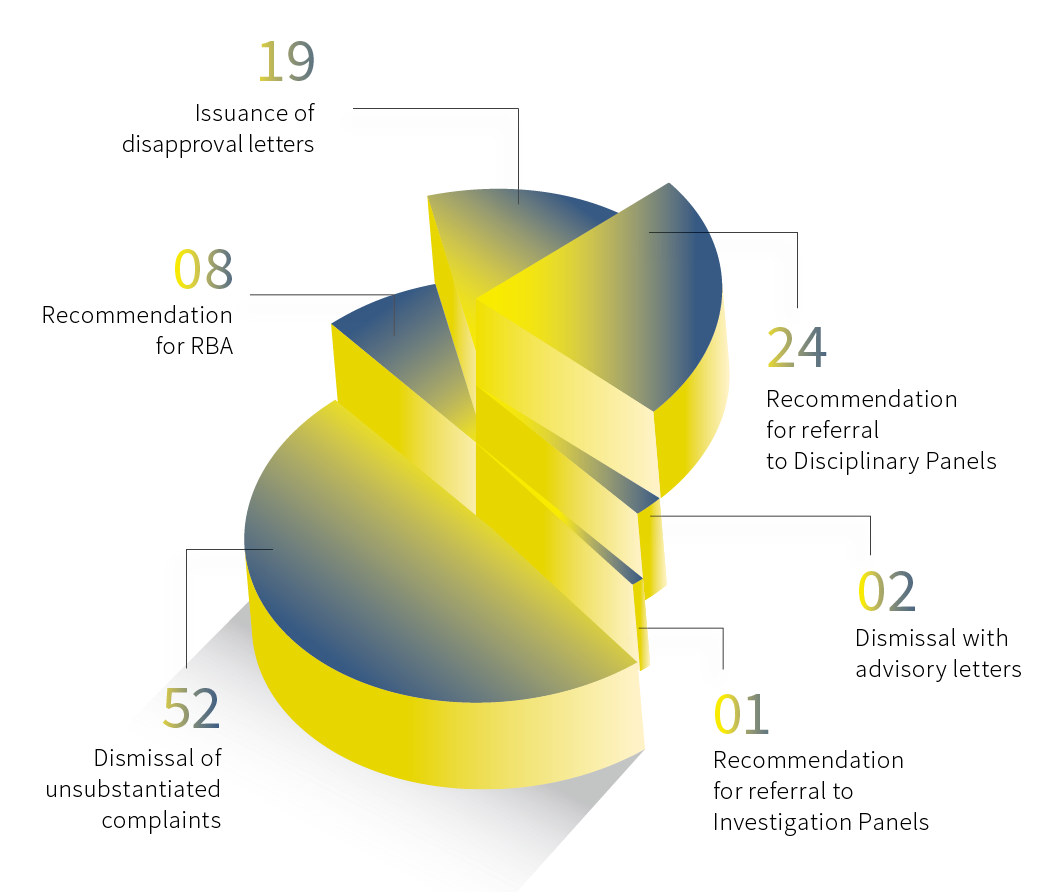

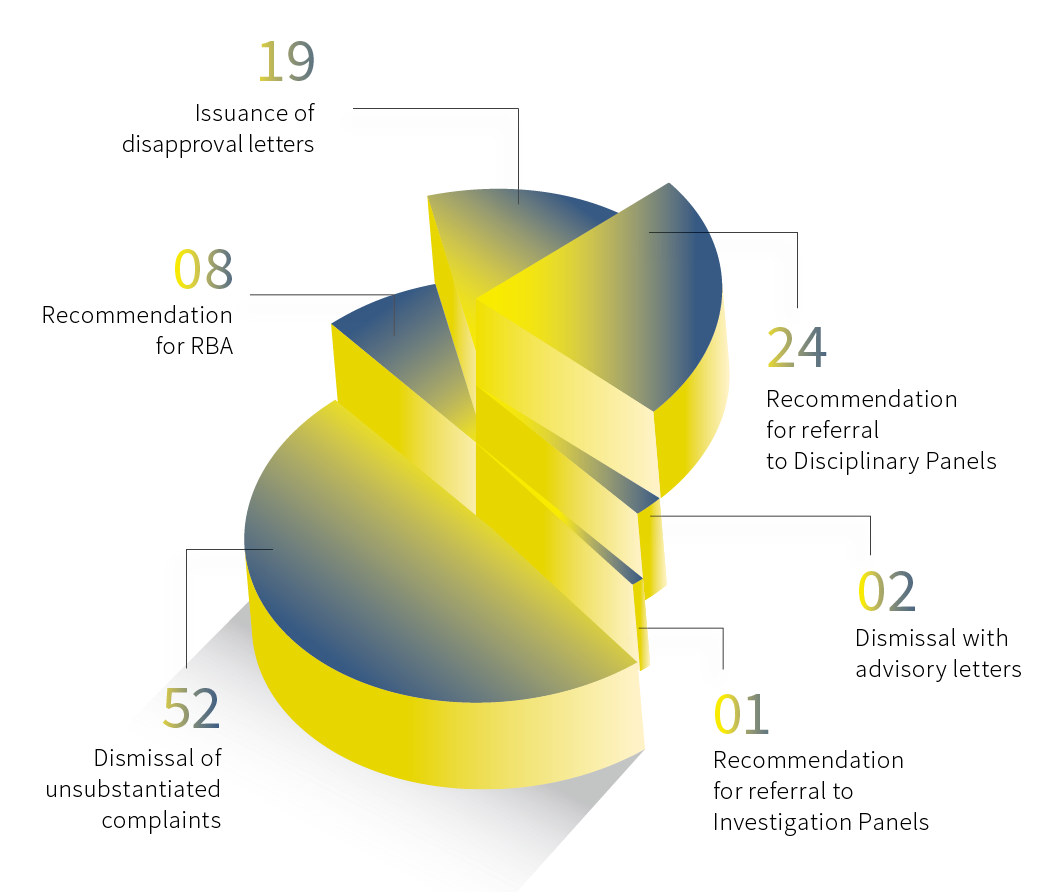

During the reporting period, 87 new complaints were received, bringing the caseload to 135. The PCC concluded 106 cases:

Case conclusions

During the reporting period, Council approved seven RBA cases. Four cases were accepted by respondents and the Institute, and they were concluded. One case was still pending acceptance by respondents, and two cases were rejected by respondents. Those rejected cases will be re-considered by Council to determine whether they will be referred to the Disciplinary Panels.

At the beginning of the reporting period, 34 disciplinary cases were in progress. During the period, Council referred another 33 cases to the Disciplinary Panels. Disciplinary proceedings for 30 cases were concluded this year.

To maintain integrity of the profession, the Institute took action against individuals or companies who fraudulently held themselves out as firms of CPAs or qualified to provide services that only practising CPAs are qualified to provide. Four cases were reported to the police during the period.

To ensure that complaint handling and disciplinary processes are dealt with according to public interest and all strategies and policies determined by Council, the Regulatory Oversight Board conducted a process review of the compliance operations. This included the activities of the PCC and disciplinary proceedings. The results of the review conducted in November 2017 were positive and the board concluded that the compliance functions had adhered to established internal procedures.

Information acquired from the complaint and disciplinary processes is used to promote good practice and raise awareness of regulatory issues through seminars and articles in A Plus. Furthermore, the Compliance Department’s 2017 Annual Report was published to promote transparency regarding the Institute’s compliance activities.